‘Women Don’t Talk Money’ Says Hena Mehta, Founder Of Basis, A Finance Management App For Women. We Ask Her Why This Is

There are some people who know what stock is at what value like the back of their hand. And then there are people like me who invest their hard-earned money tentatively and in relatively safe stock options because I don’t know better and I am entirely lost when it comes to these. But I am able to handle my money, decently. But as you probably know, not a lot of women can say the same thing. Money can be an awkward topic in marriages, or even in family homes. Like sex. But then people know you’re having it. With money and finances, no one really knows.

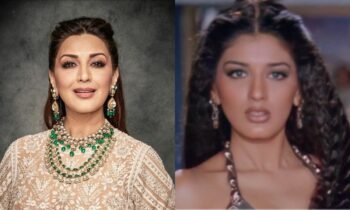

Of course, you want to throw around the ‘what’s your package?’ joke in an arranged marriage conversation, but other than that, money can be quite a hush hush topic. Especially so for women because so many are not making the money and therefore, are entirely ignored from this aspect or if they are making money, they largely leave these decisions of what to do with their own money with a male member of the family. This is very common and that is exactly what prompted Hena Mehta, the CEO & Co-Founder of Basis to start her own venture.

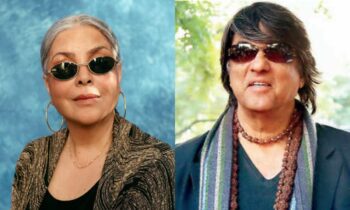

Hena teamed up with her childhood friend, and financial expert Dipika Jaikishan, who has spent more than years advising and educating individuals about money. Hena’s expertise in fintech and product management, and Dipika’s domain knowledge created the founding team for Basis, an app that helps women take control of their finances and manage them better.

So we had a chat with Hena about her journey and we had so many questions. Mainly, will I get a raise? At this point, she looked at me suspiciously so I obviously smiled cheekily and got to the real questions.

Hauterfly: Finance is traditionally seen as a man’s field. How did you get the idea to get into it?

Hena: In late March 2016, I was admitted to The Wharton School’s MBA program. A few days after I heard about the admission, the elation of getting accepted started to wear off a little, and reality began to sink in. It suddenly dawned on me: how was I going to pay for this whole thing? As we all know the cost of a higher education abroad is no joke. I didn’t want to take on a large student loan as that would destroy my entrepreneurial dreams post MBA. And so – I liquidated all my retirement savings, my family pitched in a little and I ended up taking a small loan to cover the cost of the MBA. In hindsight, I wished that I had planned my finances more prudently when I started working at the age of 21, and made use of compounding to grow my wealth. I knew at the time that I needed to do something about this problem: why don’t more women take charge of their finances to power their life goals?

Upon returning to India in 2018, I validated that I was not alone in my challenges with managing money. Interacting with over 500 urban women across the country through surveys and interviews told me that a large majority of women are in the same boat. This sowed the seeds for Basis.

I teamed up with my childhood friend Dipika Jaikishan.Our primary research showed that a large majority of women take a backseat with their money management and have a strong intent to change this. The existing behaviour stems from a lack of knowledge, a lack of trust, and not being able to relate to existing financial services and products. Incumbents in the space have defaulted to men, and don’t cater to the “other” 50% of our population. Women’s lives are structurally different from those of men, and this deeply impacts their finances: women outlive men (on average by 5 years), have higher healthcare costs and earn lower incomes. Moreover, the Indian woman’s life is also evolving rapidly: she is fiercely ambitious, choosing to stay single for longer, has strong aspirations (including lifestyle and travel goals), and is prioritising her ambitions. These were all indications that there was a strong need for a financial platform catered for women’s needs and goals.

With few options in the market to cater to women, we envisioned a platform that will speak to and address the financial needs of urban women, not as an extension of a male-centric product, but to a woman, as she is. Strong, independent and full of choices. So the next time a woman wants to make a financial decision, she doesn’t have to lean on a male member of her family or go through all the male-centric financial options and then attempt to choose the one that fits closest to her, but rather, she goes through financial options that are already tailored for her and then makes informed decisions about her money. When women think about a financial question, Basis will be one of the top three places they will seek advice and recommendations from.

HF: What are the hurdles you face in this industry because of your gender?

Hena: Since we are a “by women for women” startup, initially it was hard to find believers to back us financially. Since most startup investors are male, we found that it was hard for them to relate to or find conviction in our idea initially.

While it took some time and effort, we have been fortunate to have found a great set of investors who believe in our mission, and who share our belief that Basis can be a massive company in the years to come.

HF: Do women in India not make financial decisions in a household? How do you bring about a cultural change in something like this?

It depends on the type of financial decision. For decisions related to managing household expenses and purchasing assets such as gold, we’ve seen that women tend to take on a bigger role. However, for investment and insurance related decisions, women tend to take a backseat. There are exceptions to this, of course.

The cultural shift is already happening in a lot of ways. Through our surveys, we’ve learned that even though the status quo is that men make the major financial decisions, there is a strong intent and desire for women to make these independently, or at the very least play an active role in the decisions. Women are choosing to stay single for longer, living away from parents and prioritising their work (whether a job, or starting a business).

India’s digital revolution is enabling women to live independent lives. Google’s recent Consumer Insights report talks about how Indian women with early access to the internet are prioritizing their professional careers, renting their own apartments, and traveling on their own.

HF: Broadly, what should women be doing differently when it comes to finance?

Hena: 1. Build deep knowledge about money: The biggest barrier to taking ownership of money is the lack of knowledge. Chalk out as little as 30 minutes a week to stay on top of your financial situation – investments, expenses, insurance and future goals. The Basis app is a great way to do this without getting overwhelmed :)

2. Talk money with your friends and family: When was the last time you chatted about money with your friends over lunch or coffee, or with your parents or spouse? Normalise talking about money, so you learn and grow with your friends and family members.

3. If you’re new to investing, start with small amounts: While investing in mutual funds might seem daunting because of the vast amount of dense information out there, start by investing with small amounts. You can create an SIP (Systematic Investment Plan) for an amount as low as Rs. 500 a month. Once you get comfortable with investing, write down your financial goals, work backwards and see how much you need to save and invest to hit those goals. The Basis app has tools to help you learn, and plan out your investments and goals.

HF: What is the financial advice you would give to women in India?

Hena: ● Plan for a longer retirement: statistically speaking, you are likely to outlive your spouse!

● Don’t treat health insurance as optional – and ensure you have adequate cover. Even if you have a policy from your employer, consider getting individual health insurance to make sure you are well covered in the case of large medical expenses. A cover of INR 5-10L is recommended.

● Invest as early as possible to make use of the magic of compounding.

● Build a good credit score starting in your 20s!

HF: What are some of the biggest money mistakes Indian women are making?

● Leaving all the money decision making to the men. A recent survey by DSP showed that 13% of women said they were forced to figure out their finances due to divorce or death of a spouse. Why wait for a crisis to understand and make financial decisions? Make money management at least a monthly exercise.

● Sticking to safe ways of saving and investing such as Fixed Deposits, and not looking at inflation-beating investments such as mutual funds or equities. This typically happens due to a lack of knowledge, and lack of unbiased, trustworthy financial advice.

● Not talking about money. This is a huge problem – money is considered a taboo discussion topic amongst family members and friends.

HF: Some finance myths you need to bust for women reading this.

● Myth 1: Women are bad with money and investing

Contrary to what people might think, women are better investors than men! Data has shown time and again that women’s portfolios generate better returns than those of men, and that our natural instincts make us better long term investors.

● Myth 2: Women like to play it safe

Women are not necessarily risk averse, we are just better risk managers. What we’ve seen is that once we as once the knowledge gap is addressed, women are willing to take on more risk with their money.

● Myth 3: Women are impulsive shoppers and hence can’t save

Blame the media’s portrayal on women who squander away money on shoes and clothes (remember Carrie Bradshaw who couldn’t afford rent because she bought like a hundred pairs of expensive shoes?). The truth is that men make impulsive shopping decisions similar to women. In fact some studies show that men make more impromptu shopping decisions than women.

https://thehauterfly.com/lifestyle/reports-show-girls-are-more-likely-to-bear-the-brunt-of-the-pandemic-in-terms-of-studies-why-is-it-always-girls/